You have laid down SMART financial goals. You have been earning and saving. Then what? Just savings do not protect your purchasing power. Due to inflation the cost of your financial goals increase. The catalyst that elevates your savings to the vicinity of your financial goals is investment. Investment makes the money work for you. Investment also has risk. You need to strike a balance between risk and return. Hence no wonder this session is going to be the longest.

The first principle of investing is "better late than never". But actually it is to "start early". Investing is no rocket science that it is made out to be. Agreed that it is a bit complex, but the important aptitude is to understand one's requirement plu risk and understand the financial product well. Moreover, you don't need to be a car mechanic to learn driving. Operating a car and servicing them may need an effort to understand the mechanics of the car. But you need to understand the functions of the steering, gear, clutch and accelerator only to learn driving. Like investing, it may appear daunting for the newbie. But leave him on the steering for a week and there he goes.

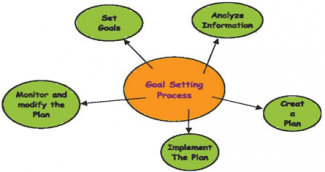

The canons to be followed before making an investment are as under:

- You have at least six months living expenses deposited in a bank, or in some other liquid form of savings, or

- You have just acquired a sudden windfall or inheritance, which should be thought of as capital and not as current income.

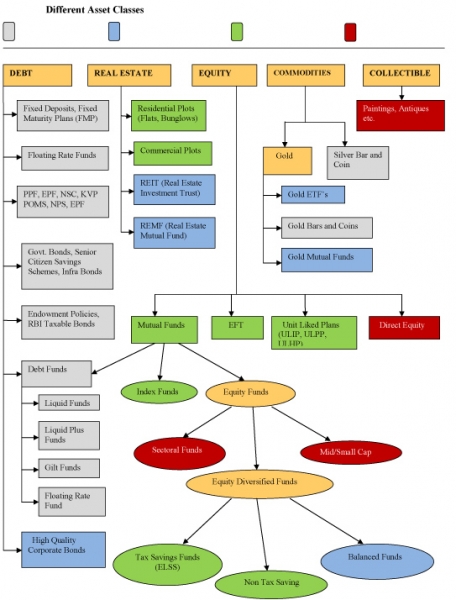

Investment avenues - Asset Classes

An asset class is a broad investing category.

The respective asset classes reflect varying degrees of risk and return. The allocation of your savings into asset classes (i.e. which and how much investment of each is suitable for you) depend on your financial goals (the amount, the timeline – short term etc.) and risk profile.

How major asset classes perform during the 20 year period ending March 31, 2014

| Asset Class | 5-year | 10-year | 15-year | 20-year |

| Equity Mutual Fund | 11.0 | 17.0 | 13.6 | 12.9 |

| Gold | 9.0 | 12.9 | 11.0 | 8.4 |

| Bank FD | 5.7 | 5.2 | 5.1 | 5.5 |

| Property | 8.0 | 13.4 | 10.8 | 6.2 |

| Return in % Source: Morgan Stanley | ||||

Few points to remember before investing

1) Strategies for investors

- Invest regularly

- Start early

- Harness the power of compounding

- Have realistic expectations

2) Good Investment will make money,bad investment will cost you money.

3) Understand the financial product you are investing on.

4) Philanthropy

- Nature gives back what it receives.

- Let us try giving something what one wants or requires the most.

- If one wants money, do some charity, if one wants contacts try giving to those whom you can help.

What reduces your return from investing?

Inflation is not the only thing you should be considering, there are other things too that eat into you money. The first thing is "brokerage" and the second thing is "taxation".

Principles of compounding

While it is helpful to understand the mathematics behind compounding, the ability to use a financial function calculator is probably more important.

There are generally four variables in any time-value-of-money problem: the time period, the interest rate or rate of return, the beginning value and the ending value. The advantage of knowing how to solve time-value-of-money problems is that it will allow them to handle a variety of "what if" scenarios in their personal lives, and they will be able to verify factors when dealing with financial products.

Risk and Return

Someone has said, "Biggest risk one can take is not to take one".

Overly cautious people who keep their money in a "safe" bank account face the risk that inflation will seriously erode their cash. Such people work hard but still retire poor with a overwhelming sense of scarcity of money haunting them.

Those who chase after unrealistically high returns in "can't miss" deals may lose their money in speculative investments. Such people also end up reeling under money problems due to unpredictable fall in the value of their investment.

Well-informed people know how to make their money grow by balancing risk and return when they make saving and investing decisions. I am sure the reader of this book elevate themselves to become "well – informed" investor.

Myth and Reality

|

Myth |

Reality |

|

If I use a broker or financial planner, I don't need to know much about investing. |

A broker or financial planner has a responsibility to investors not to make misrepresentations or commit fraud, to make recommendations appropriate to the investor, to make full disclosure of material facts and to treat the investor fairly. These requirements do not relieve the investor of the responsibility to become educated. No matter how much one relies on the advice of a broker or financial planner, the final decision about any investment rests with the individual investor. |

|

Some investments have no risk. |

All investments involve some degree of risk. The types and amounts of risk vary from one investment to another. For instance bonds are considered to have no business risk because they are issued by the government, but they may have considerable inflation risk or interest rate risk depending on economic conditions |

Risk Profile

Understanding one's risk profile is necessary. It enables you to allocate funds to various asset classes. Your risk profile depends on your responsibilities, level of income, values, habits etc.

Taxability of Investments

From taxability point of view your investment falls in any of the following category –

| On investment | Earning | Maturity | |

| E, | E, | E | – Exempt, Exempt and Exempt e.g. PF, PPF, LIC |

| E, | E, | T | – Exempt, Exempt and Taxable e.g. Annuity |

| E, | T, | T | – Exempt, Taxable and Taxable e.g. 5 yr time deposit |

Small Savings Rates and Tax Impact |

|||

|

Name of the instrument |

Rate (FY 2017) |

Maximum Amount to be invested |

Taxability |

|

KisanVikas Patra |

7.80% |

No maximum limit |

Taxable |

|

National Saving Certificate |

8.10% |

No maximum limit |

ETE |

|

Post Office 1-year deposit |

7.10% |

No maximum limit |

Taxable |

|

Post Office 2-year deposit |

7.20% |

No maximum limit |

Taxable |

|

Post Office 3-year deposit |

7.40% |

No maximum limit |

Taxable |

|

Post Office 5-year deposit |

7.90% |

No maximum limit |

Taxable |

|

Post office monthly income scheme |

7.80% |

Single A/C 4.5 lakhs, Joint A/C 9 lakhs |

Taxable |

|

Public Provident fund |

8.10% |

1.5 lakh |

EEE |

|

Senior Citizen's Saving Scheme |

8.60% |

15 lakh |

EET |

|

Sukanya Samriddhi Account |

8.60% |

1.5 lakh |

EEE |

|

5-year Recurring deposit |

7.40% |

No maximum limit |

Taxable |

CA Rishi Khator

Rishi Khator (FCA, CPA, CIFRS) is Chartered Accountant based in Kolkata. He is author of the book on Personal Finance – Right Now : How to be Financially Strong plus Happy All Along. He believes Financial Literacy is a critical like skill. He has been propagating it through workshops, events and his writings. He has reached out to working adults, college students, school children and homemakers for creating awareness in Financial Literacy.

He is also founder and partner of Chunder Khator & Associates, Chartered Accountants. The firm presently has operations in Kolkata, Mumbai, Singapore and Bangkok.