Credit & Debt

“Being Rich and looking Rich are two different things”

“The surest way to establish your credit is to work yourself into the position of not needing any.”

Basic Characteristics

The sword cuts both ways, as the saying goes. The same applies to credit: it can be a tool or a trap, depending on how it’s handled.

Used well, credit can be an asset to help build wealth as part of a financial plan; used poorly, credit can lead to excessive debt, which can quickly consume an individual’s financial resources.

When credit is abused, it can lead to excessive debt and potential bankruptcy.

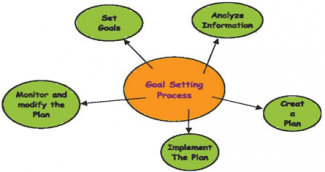

Am I heading towards Debt Trap

You can evaluate your loan payments vis-à-vis your income and determine if it is excessive.

Is my Debt Load too High?

Your Financial Friend determines if your debt load is too high. Find out how do you fare in managing your debt by following the link: http://rightnow.co.in/calc.html.

It is easier to get into debt than to get out of it.

If you are one of the millions of people who are indebted then you must be very shrewd and see to that you are taking all the steps to Eliminate Debt, and to keep yourself debt free. Getting into debt is easy .Without the right knowledge or advice; many people end up in a lot of trouble. It is hard to believe, but sometimes even little changes can drastically reduce your risk of debts.

Credit Bureau

A middle-level executive at a very large public sector bank was recently denied a home loan by a private bank. The reason? The gentleman’s poor credit history. He hasn’t repaid an auto loan he took from another bank.

A credit bureau collects, maintains and sells information about consurmers’ credit history. It gathers information about consumers’ payment habits from credit granters such as banks, non-banking finance companies and mortgage firms, stores this information in a computer database and sells credit reports after assigning scores to the borrowers, based on their payment history. These reports help banks and other loan givers to take a call on the creditworthiness of a loan seeker and decide the interest rate.

Cibil, India’s oldest and largest credit information bureau with records of around 157 million individual borrowers. The Indian banking regulator allowed three more of credit bureau to set up shop. They are Experian Credit Information Co. of India Pvt. Ltd., Equifax Credit Information Services Pvt. Ltd. and High Mark Credit Information Services Pvt. Ltd.

The banks track the re-payment history of every customer through consumer credit bureaus. It is for this reason you must keep your creditworthiness intact. This you do by paying loans on time. Defaulting customers may not get fresh loan or /and may get new loans at higher rates of interest.

Emergency Corpus and Debt

We suggest that you have four to six months' worth of living expenses in your emergency corpus. For detailed discussion on this please refer to Session on Savings

Your credit line can be a secondary source of funds in a time of crisis. Borrowed money, however, has to be paid back (often at high interest rates). As a result, you shouldn't consider lenders as a primary source for your emergency corpus.

Percentage of EMI in Monthly Income

As a thumb rule maximum permissible EMI is fixed in the range of 30%to 40% of the customer's gross monthly income or 50% of the ‘net monthly income’. 50% is the upper limit, though the ideal figure is 30%.

Wise people say: Borrower becomes the lender’s slave.

Some tips to avoid debt are:

- Choose to Pay with Cash Instead of Credit Cards for smaller purchases.

- Stick to a budget

- Avoid buying “Doodads”.

- If you do have to borrow money, make sure you choose the lender with the lowest lending

rate

- Save some money, even if it is only a small amount, each month, deposit it in a savings

account

Details on ways to save are furnished elsewhere in the Session on Savings.

Whether to repay or continue loan

Understand your actual cost of interest over the duration of loan. Compare the same with your income from investment. Given below is an interesting situation –

Pradip has taken Rs.15 lac housing loan for a tenor of 15 years. He has opted for flexible rate option. The interest rate has increased to 12%. He has an option to repay housing loan or make an investment of the said amount in 8% instrument compounded annually.

Pradip is almost on the verge of repaying the loan. Luckily, he met his financial advisor, Ramesh. Ramesh advised Pradip to decision after determining the actual interest cost and earning over the period of loan. Pradip demonstrated that it makes sense to take loan and make investment simultaneously.

He explained that total interest paid on loan with 12 % reducing interest over 15 years is Rs. 17.40 lacs. His total outflow is Rs.32.40 lacs. His inflow at the end of 15 years from investment in 8% instrument is Rs.47.58 lacs ! Hence it makes more sense for Pradip to take loan and invest his surplus fund as above. By his wise decision Pradip generates a corpus of Rs.15 lacs over the years. This calculation ignores the tax impact. If considered, it will further subsidize cost of loan.

However, the decision to take loan is subjected to other parameters like loan repayment portion of his total monthly income and liquidity needs.

Credit Card – Credit period and Finance Charges

As mentioned above, credit card is a deferred credit mode of payment, credit card should be used just to defer your payment (for purchases made) upto the specified due date. Normally credit cards allow interest free credit upto 45-55 days, from the date of purchase to the payment due date.

Credit card charges very high interest rates, generally above 30%p.a., if payment is not made within due date.

Following types of finance charges are levied in credit cards in respect of delayed payments.

Interest ( the biggest cost)

Penalty

Service tax (presently @10.30%) on both

Over limit fees, if credit limit is exceeded.

Hence, a delay in payment of even one day will entail substantial finance charge on the above counts. Hence, when a credit card holder does not pay in full the transaction charges (i.e. outstanding balance), he does not get any grace period.

Similarly, if credit card holder withdraws cash, the interest rate is applicable from the date of withdrawal to the date amount is repaid in full.

Making purchases on credit?

It is important to answer the following questions before making purchases on credit: Make sure you are not purchasing “avoidable Vilas”. Make sure your debt burden is not high (remember your Financial Friend).

- Do you really need this item?

- Exactly why do you want this item?

- Can you afford this item?

- How will purchasing this item bring me closer to my financial goals?

- What will happen if you cannot repay this loan?

- Do not borrow to invest in shares or volatile assets

Credit Characteristics

- Credit is a loan

- When availing credit go slow

- Housing loan and loan against fixed deposits are cheapest forms of loan

- Shop for an account with the best term

- Make payments on time

- Pay off credit card balances each month.

Buy vs Rent Calculator

We often dream about having our own house/flat which is generally the single biggest investment of our lives.

We are frequently tempted to buy & fulfill our dreams. Your Financial Friend brings to you, the logical steps in deciding whether to buy or rent a house. Follow the link: http://rightnow.co.in/calc.html and work with your own real numbers

Networth

Each of us has a certain networth. Just as companies and businesses have. Your networth is calculated by deducting loans (taken) and other payables from accumulated assets. Assets should be considered, as far as practicable, at current market value.

Higher the networth, more wealthy you are. You should strive to increase your networth by making wise investments and disciplining yourself from taking avoidable loans. You should also keep track of movement of your networth. Regular Review (at least once in a year) of this movement will enable you to identify your past mistakes and avoid its recurrence in future. Rising networth will increase your ‘feel good factor’ and sense of self esteem.

Your Financial Friend calculates for you your networth and enables you to keep

track of it by following the link: http://rightnow.co.in/calc.html.

CA Rishi Khator

Rishi Khator (FCA, CPA, CIFRS) is Chartered Accountant based in Kolkata. He is author of the book on Personal Finance – Right Now : How to be Financially Strong plus Happy All Along. He believes Financial Literacy is a critical like skill. He has been propagating it through workshops, events and his writings. He has reached out to working adults, college students, school children and homemakers for creating awareness in Financial Literacy.

He is also founder and partner of Chunder Khator & Associates, Chartered Accountants. The firm presently has operations in Kolkata, Mumbai, Singapore and Bangkok.