We had posted two articles by CA Rishi Khator on financial management earlier. The last one was titled 'Money Management - Create Your Future'. We are now posting the third article of his which is titled 'Setting Financial Goals'.

If one does not know to which port one is sailing, no wind is favorable* (Seneca).

Why setting goals is important

Money's an antagonist, an enemy that keeps you from doing what you want to be doing. The first step for learning how to integrate money into yow life and use it successfully as a tool is to figure out what exactly you wish to build with that tool.

Studies show that most people do not accomplish their goals, because they fail at the very first step that requires setting clear and realistic goal.

Most people state goals like, “I want to move in a nice house", “I want to make more money” or “I want to lose weight”. All of these goals are very general and vague.

It is similar to saying, “I want to spend my vacation at some place nice" without specifying what is "nice" for you. You may find yourself stuck in the middle of the jungle and trying not to get bitten by venomous snakes.

If you really know what you want out of life, it’s amazing how opportunities will come to enable you to carry them out.

Writing your goal alone increases your odds of success by 1000%.

Goals help guide individuals toward personal and financial accomplishments. Financial Goals depend on your age, needs, wants, habit, attitude, education, values, determination, culture etc.

Your well written Goals will also describe - What do we want to achieve in life? What do we want to do, be and have?

Your greatest "wealth" is not money. It is your state of mind, your thinking and understanding -- proper (not necessarily conventional) education.

An essential ingredient in achieving goals is the practice of persistent and consistent saving. The earlier in life this practice begins, the better. Before we embark upon setting our own goals, we need to understand following key concepts in money and investing.

Key Concept

Asset is an item of ownership. It includes cash, investments etc. However simply put asset is anything that puts money in your pocket.

Liability is defined as moneys owed; debts or pecuniary obligations. Something for which one is liable; an obligation, responsibility, or debt. Simply put liability is anything that takes money out of your pocket.

Income is the amount of money received during a period of time -

In exchange for labour or services,

From the sale of goods or property, or

Profit from sale of financial investments

Rent received

Dividends received from Shares/Mutual Funds

Interest on loan given

Royalty from copyrights/patents/technical knowhow etc.

Expense is defined as

Any cost or charge

Interest

Rent paid

Loss on sale of investments

Cashflows is defined as the inflow or outflow of cash or cash equivalents (like bank payments, deposits, etc).

The above definition may not be as per the dictionary but is relevant in context to financial planning. For example, we call building an asset even if it is held for residential purpose but from the view point of financial planning we shall call it our liability as it will not generate any income for us but will surely increase our cash outflows.

"Vilas" are those material possessions (like an LCD TV, latest model of mobile phone, bigger car etc.) that we spend our money on. When you spend money on "Vilas", you incur a notional loss of return on investment that you would have otherwise made. You should minimize Vilas and maximize assets. As money is scarce purchase of Vilas diverts money from savings (and financial goals).

Savings goal is the amount you wish to have in savings at the end of this savings plan. A person has several saving goals. E.g. Goal for buying a house, buying a vehicle, retirement fund etc.

Each goal has period, the amount to save and the purpose of saving.

Saving goal may have different timelines. E.g. saving goal for retirement will have a longer time line than saving goal for buying a vehicle.

Years to save are the remaining number of years you have to save in respect of a particular saving goal.

Amount currently saved is the total you have currently saved toward your savings goal.

Monthly savings is the amount you will contribute each month to your investments.

Needs and Wants

Goals begin with understanding the difference between needs and wants and learning to prioritize them, while recognizing that resources are always limited.

Wants often give us the desire to succeed. The important thing is to be able to distinguish between a want and a need and to use that understanding when making important choices and decisions.

In the economic parlance, we define needs as under:

- A need is something you have to have, something you can't do without. A good example is food. If you don't eat, you won't survive for long.

- A want is something you would like to have. It is not absolutely necessary, but it would be a good thing to have.

These are general categories, of course. Some categories have both needs and wants. For instance, food could be a need or a want, depending on the type of food. What is a need for one could be a want for the other. It is important that you strike a balance between those things that you have to have and the things that you would like to have. Ask yourself how much each purchase will IMPROVE your quality of life as a person.

As I mentioned earlier that your aim must be to minimize "vilas".

If you buy things you don’t need, you end up selling things you need

Therefore, before making any purchases, we can make a Need-Want quiz in relation to the desired item, a sample of which is illustrated below:

NEED-WANT QUIZ

- Is a house a want or a need?

- Is a car a want or a need?

- What about a DVD player? Want or need?

Do test your Financial Smartness by clicking on the link below and answering few questions. You should also chart your progress by testing yourself every 6 months.

P.Y.F. ("pay-yourself- first") philosophy

Practicing this philosophy requires delaying satisfaction. There is a tradeoff between satisfying today's needs and wants, and satisfying tomorrow's needs and wants. P.Y.F. means that, before spending any income, a portion of it will be set aside - savings- for the future.

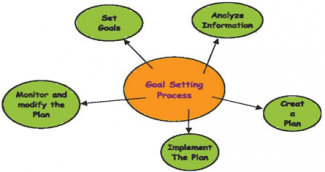

Goal Setting Process

Spend after saving and not save after spending

Attributes of Goal setting

One should endeavor to set "SMART Goals". This is how we can make our financial goals effective

S = Specific (is clearly laid down and understandable) M = Measurable (can be expressed in Rs)

A = Attainable (can be met)

R = Realistic (compatible to circumstances and resources)

T = Time-bound (with set deadlines)

Click on the link below to work out your saving goals with your own numbers.

CA Rishi Khator

Rishi Khator (FCA, CPA, CIFRS) is Chartered Accountant based in Kolkata. He is author of the book on Personal Finance – Right Now : How to be Financially Strong plus Happy All Along. He believes Financial Literacy is a critical like skill. He has been propagating it through workshops, events and his writings. He has reached out to working adults, college students, school children and homemakers for creating awareness in Financial Literacy.

He is also founder and partner of Chunder Khator & Associates, Chartered Accountants. The firm presently has operations in Kolkata, Mumbai, Singapore and Bangkok.