“Most people don’t plan to fail. They simply fail to plan.”

Planning brings future to present. By planning we reduce uncertainties of future. This makes us less anxious about future. Once we have planned, future is more known to our and we enjoy our Right Now moments more.

Financial planning is a thinking process, not just a product. A financial plan is based on what each of us consider most important.

Answer the following questions when framing a financial plan:

- What are one’s short- and long-term goals?

- What is one’s total income after taxes and deductions?

- What are one’s current living expenses?

- What changes in living expenses do our expect?

- How much can our realistically save each month for future goals such as college expenses or a down payment on a car?

- What are one’s liquidity needs?

- Are our using credits wisely (if applicable)?

- How can our protect against inflation?

- How can our plan for retirement?

To be financially strong it is relevant to have financial plan because it helps one to:

- Take charge of one’s economic destiny.

- Live within one’s income.

- Identify financial priorities.

- Allocate funds to meet expenses.

- Meet financial emergencies and reduce undue dependence on credit.

- Reduce uncertainty and conflict about financial affairs.

- Gain a sense of financial independence and control.

- Save and invest to reach financial goals.Bottom of Form

We give below few Myth and Reality pertaining to Financial Planning. It will help spruce up one’s concept

|

MYTH |

REALITY |

|

I don’t earn enough money to need a financial plan. |

A financial plan is a tool that helps people to live within their income. It also allows them to make better use of their money. |

|

Investing is just for people with a lot of money. |

Investing is for all income levels. People don’t have to be rich to begin investing but they must have an understanding of basic investment products and their risks and rewards. |

|

Ourng people don’t need to think about saving for retirement. |

Today’s ourng people can expect to live 20 or more years in retirement. Those who begin early to contribute to a retirement savings plan are more likely to have money for a comfortable retirement than those who do not. Saving small amounts of money over a long time makes use of the magic of compounding. Employer-based savings programs are tax-deferred, and the employer contributes to his/her account as well. That’s free money. |

|

EPF is a business-funded program to provide financial aid to people who are retired. |

EPF is an employer and employee funded government program that provides a base-level retirement income. It is not designed to be the sole source of retirement income.

|

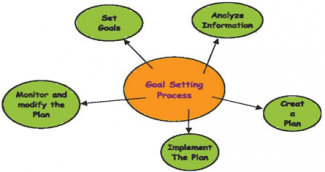

Decision making plays an important role in the financial planning process. Making choices is about using our limited resources in the best possible way to accomplish goals.

Preliminary way to financial planning is tracking personal spending – Personal Spending Record. Please refer Financial Friend on Monthly Budget & Expenses Tracker by following the link - http://rightnow.co.in/calc.html and click on Monthly Budget

Common Money Mistakes

In my extensive experience of handling financial issues of my clients, I find following are the common money mistakes committed by more than 75% of people :

Investments done in adhoc basis

People get lured by appeal of the advertisement and impulsively make investments. Rather than identifying ones goals and then making investments suitable to that, most of the people first identify the investments and then thrust it upon one of the financial requirements.

Over the time this pattern develops into a bundle of instruments that do not suffice one’s financial requirements in the time of need.

Insurance as Investment

Most of the people take insurance as investment tool rather than risk mitigation tool. This adds to the cost of risk coverage. We also have to bear the burden of investments carrying very low returns. (A typical policy of insurance return around 5-6% on amount invested).

Lack of Insurance Coverage

People are simply unaware of quantum of their insurance requirements. In India most of the people suffer from underinsurance. Remember! Under insurance is no insurance. For many people insurance do not include critical illness cover or an adequate medical cover.

Too Many Doodads

People tend to unnecessary tighten their finances with lifestyle possessions like bigger car, latest mobile, etc. They do not evaluate whether there is room for such luxuries given their future financial requirements.

Lack of Financial Plan

Most people do not understand the relevance in their personal life, of financial goal setting, cash flow, systematic savings, retirement and estate planning etc.

It is because of limited knowledge, they end up making costly mistakes. I have met many who realize this a bit late in their life.

Dabbling in Share Market with “Tips”

By nature investment in Equity Share is risky. When the capital market rises many people rush to investing in shares without having requisite knowledge. They rely on friendly “tips”. Such people frequently end up losing hard earned money.

Financial Plan

I summarize below the steps for developing one’s own Financial Plan. Few concepts mentioned here may be elaborated more in other Sessions. Hence revisit this part after one has participated in all the Sessions.

Step 1 Identify financial goals specifying nature, monetary value and time. The nature of financial goals can be - Child education

Self / Child Marriage

Home buy

Vehicle purchase

Retirement

Medical risk cover

Life risk cover

Critical illness cover

Vacation etc

Note – The money stated against the goal will be money required at the specified time. If we can estimate the monetary value at present rates, we can find out future value amount using Financial Friend – Visit the link : http://rightnow.co.in/calc.html and click on the calculator Future Value of Money.

Step 2 Understand one’s risk profile. Remember “The riskiest investor of all is the person who is out of control of his/her personal financial trait”

Step 3 Determine asset allocation as per own risk profile. Depending upon one’s financial goal, we may want to allocate some amount to low risk low return asset class, some to medium risk and return and others to high risk and return. Return on investment depends on asset allocation to various investment products

Step 4 Work out one’s savings requirement for each goal on the basis of estimated return on asset class worked out above.

Step 5 Observe self discipline to follow the above plan. One’s financial intelligence empowers one to understand financial products and take well informed decision.

Step 6 We may also want to add loan element to achieve some goals like home buy. Consult Financial Friend to determine how much loan we should take. We must not let ourself in large debt situation – debt trap. Visit the link : http://rightnow.co.in/calc.html and click on calculator How much Debt

Step7 Review investments every quarter. As one progresses in life, review life insurance and medical risk cover.

CA Rishi Khator

Rishi Khator (FCA, CPA, CIFRS) is Chartered Accountant based in Kolkata. He is author of the book on Personal Finance – Right Now : How to be Financially Strong plus Happy All Along. He believes Financial Literacy is a critical like skill. He has been propagating it through workshops, events and his writings. He has reached out to working adults, college students, school children and homemakers for creating awareness in Financial Literacy.

He is also founder and partner of Chunder Khator & Associates, Chartered Accountants. The firm presently has operations in Kolkata, Mumbai, Singapore and Bangkok.