Late one afternoon, I received an urgent phone call from Sukumar who is a top ranking marketing official in a company to whom our Firm provides professional services.

Sukumar had earlier referred to me his growing personal financial problems. So, when he gave the call I could sense something burning. We set up a time during lunch hours.

As I had guessed, Sukumar, despite earning around Rs.12 lac, per annum, had put much of his savings in few shares on the basis of some tips. Those shares turned out to be penny stocks and their value was down 75%. Sukumar had prior commitments for housing loan and has recently been mounting debts even in his credit cards. He could not discuss his precarious position with friends or even his family. He was distraught and disillusioned. He desperately needed guidance.

People from various walks of life do come to me with such problems.

Problem is not the money. Problem is lack of financial intelligence. Our traditional education falls short of our need for developing personal money management skill. We deal in our everyday life with so many monetary decisions, results whereof fundamentally affects our financial security, workplace effectiveness, family relationships, peace of mind and our state of happiness.

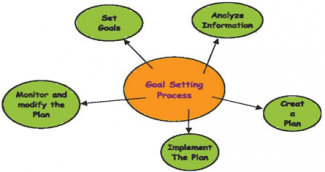

I earnestly believe implementation of the basic concepts of personal finance –

- financial goal setting,

- developing personal financial plan,

- household budgeting,

- insuring life and property against risk,

- borrowing cautiously, investing in diversified asset classes as per risk aptitude

is most likely to keep us Financially Strong All Life Long.

Personal Financial Literacy is Economic self defense, those who learn the most will be the safest.

Many among us are confused. We do not have dear concept. We avoid reaching out for the right criterion, while taking decisions on money, insurance, loans, retirement planning, investing and taxation. Such people tend to fall in for easy options or options suggested by financial agent (who has his own agenda that is often at variance with our needs).

Financial Literacy helps us gain Control over money and other financial resources and make responsible decision. It makes us financially smart. We learn how to use concepts of accounting and investing to better our financial well being

Education is the foundation of success but not sufficient for the same.

To have a financially secured future we need more than just following the old set of rules viz. get educated and take up job.

- We want to see our-self enjoying life

- We want to be effective and successful in our work

- We want to be financially free

- We want to be Happy

If we want to change the situation, change our-self. If we want to change our-self, change our perceptions.

The difficulty lies in not the new ideas. But in escaping from the old one. Today we are facing social and technological changes at pace greater than ever before. We have two choices - either to walk safe or to walk smart by preparing ourselves, getting educated and empowering ourselves with knowledge and skills of personal finance and money management.

CA Rishi Khator

Rishi Khator (FCA, CPA, CIFRS) is Chartered Accountant based in Kolkata. He is author of the book on Personal Finance – Right Now : How to be Financially Strong plus Happy All Along. He believes Financial Literacy is a critical like skill. He has been propagating it through workshops, events and his writings. He has reached out to working adults, college students, school children and homemakers for creating awareness in Financial Literacy.

He is also founder and partner of Chunder Khator & Associates, Chartered Accountants. The firm presently has operations in Kolkata, Mumbai, Singapore and Bangkok.